The valuation of a company is not an exact science and can vary depending on the type of business and the reason. There is a wide range of factors involved in the process, from book value to a set of tangible and intangible elements. In general, the value of the business will depend on the analysis of the cash flow of the company. In other words, its ability to generate constant profits will ultimately determine its value in the market.

Among the methods usually used to obtain a value, we can mention the following:

1. Valuation of assets: Valuation of assets is used when a company has a large number of assets. Retailers and manufacturing companies fall into this category. This process considers the following figures, whose sum determines the market value:

- Fair market value of fixed assets and equipment. It is the price that would be paid in the free market to buy the assets or equipment.

- Improvements to leased property. It is the changes to physical property that would be considered part of the property if it were sold or not renewed a lease.

- Benefit of the owner. It is the seller's discretionary cash for one year and can obtain it from the adjusted income statement.

- Inventory. The wholesale value of the inventory, including raw materials, incomplete work and finished goods or products.

2. Capitalization of the valuation of profits: This method does not give value to fixed assets, like the equipment and considers a greater number of intangibles. This method of valuation is best used for companies with few assets, such as service companies.

The factors taken into account in this valuation method are as follows:

- Owner's reason to sell

- Period in which the company has been in business

- Period in which the current owner has owned the business

- Degree of risk

- Cost effectiveness

- Location

- Growth History

- Competition

- Barriers to market entry

- Future potential of the sector

- Customer base

- Technology

3. Valuing owner's benefits: This formula focuses on the seller's discretionary cash flow and is generally used to value companies whose value comes from their ability to generate cash flow and profits.

4. Market valuation or multiplier: This method obtains the value of a business by using an "industry average" sales figure as a multiplier. This average number of the sector is based on the value for which similar companies have recently been sold. As a result, a specific formula is created for the sector, which is usually based on a multiple of gross sales.

Methodology

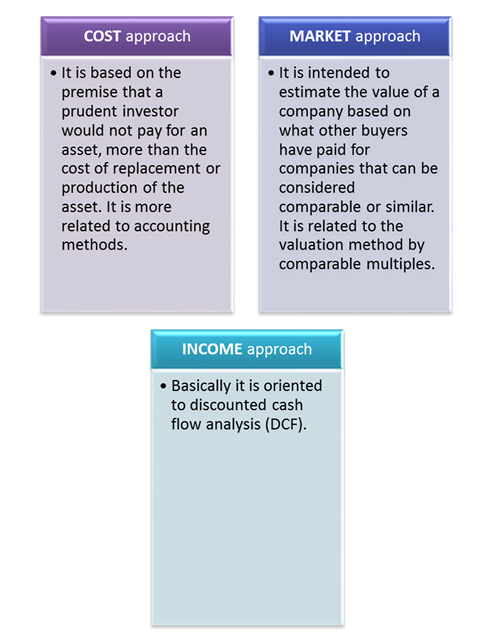

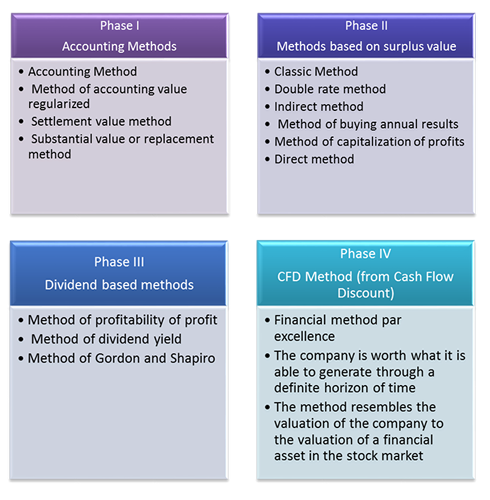

The methodology used by our firm is based on three alternative valuation approaches.

Similarly, our methodology raises three alternative approaches to valuation.